Earning on Autopilot: The Role of Your Online Presence in Passive Income

Just like smart investments grow wealth over time, your online presence can become a valuable asset that generates passive income. Whether through affiliate marketing, digital products, or automated sales funnels, a well-structured online platform works much like a diversified portfolio—earning you money while you focus on other pursuits. But just as with financial investments, success requires strategy, patience, and the right tools.

What is passive income?

It's common for people to go to work or perform tasks to earn income. This is considered active income. It means that a person constantly makes some efforts and receives a reward for them.

There are several important disadvantages of this type of income. First, you need to spend time doing work all the time. This means that you have very little time to satisfy your own whims and hobbies. And if you take into account household chores, you don't have enough energy or opportunities, and sometimes even the desire to take care of yourself.

Passive income is a completely different story. This is money that regularly comes to the owner, regardless of his or her ability to perform tasks, age, or health. In other words, these are funds or efforts that are spent once and bring constant income in the future.

There are several types of passive income. Generally, they can be categorized into two main groups:

- Investment. This is passive income that requires initial investments. In other words, to receive regular income, the owner has to invest money. It can be the purchase of shares, real estate, or other financial transactions.

- Intellectual. There are no financial investments. A person receives income from what he or she has done with the help of his or her own knowledge and skills. For example, payments for copyrights, inventions, and royalties for printing and selling works.

Fun fact. Receiving social assistance from the state can be considered passive income. That is, a person does not have to perform any tasks to receive survivor's benefits or pensions. So, we can consider this a type of passive income.

In recent years, the FIRE social movement has been gaining popularity in the United States and some European countries. Its meaning is that people unite with a single goal - to make a profit regardless of their health. The goal of the participants is to make as many different investments as possible. Thus, at the age of 35-40, they become completely financially independent thanks to passive income. Without waiting for retirement or other set deadlines, the movement's members quit their jobs and start living for their own pleasure, with regular payments that are enough to travel and fulfill other desires.

Important! Some types of passive income are taxed by the state. Therefore, before starting a business, you need to clearly study the requirements of the law.

Passive income: where to invest?

You need to understand that earning passive income is not an instant thing. It requires market research and analytics. In other words, to make a profit on a regular basis, you need to make considerable calculations. Determine how much money and time you will need. And then calculate what investments will be needed to obtain the specified amounts. Those who prefer to receive passive income without investments will have to spend their own time and apply knowledge. But it is also necessary to calculate further payments. Moreover, you need to understand how long it will take for you to receive income. This will help you figure out how much and where to invest.

In other words, you need to know what you need to know to create passive income competently:

- “Entry threshold”. The size of the asset that will allow you to receive a certain amount.

- The level of risk. How stable the acquired asset is and whether there is a risk of its depreciation.

- The time of return of the invested funds and the beginning of profitability.

- Liquidity. The time frame in which an asset can be sold if necessary. It is important to be able to sell assets in a short time and without losing the money invested. And preferably, with a profit.

- The period of preservation of the asset's value. Everything can depreciate over time.

Therefore, it is important to foresee this process in advance and purchase another object in time to make a profit, and sell the existing one without loss.

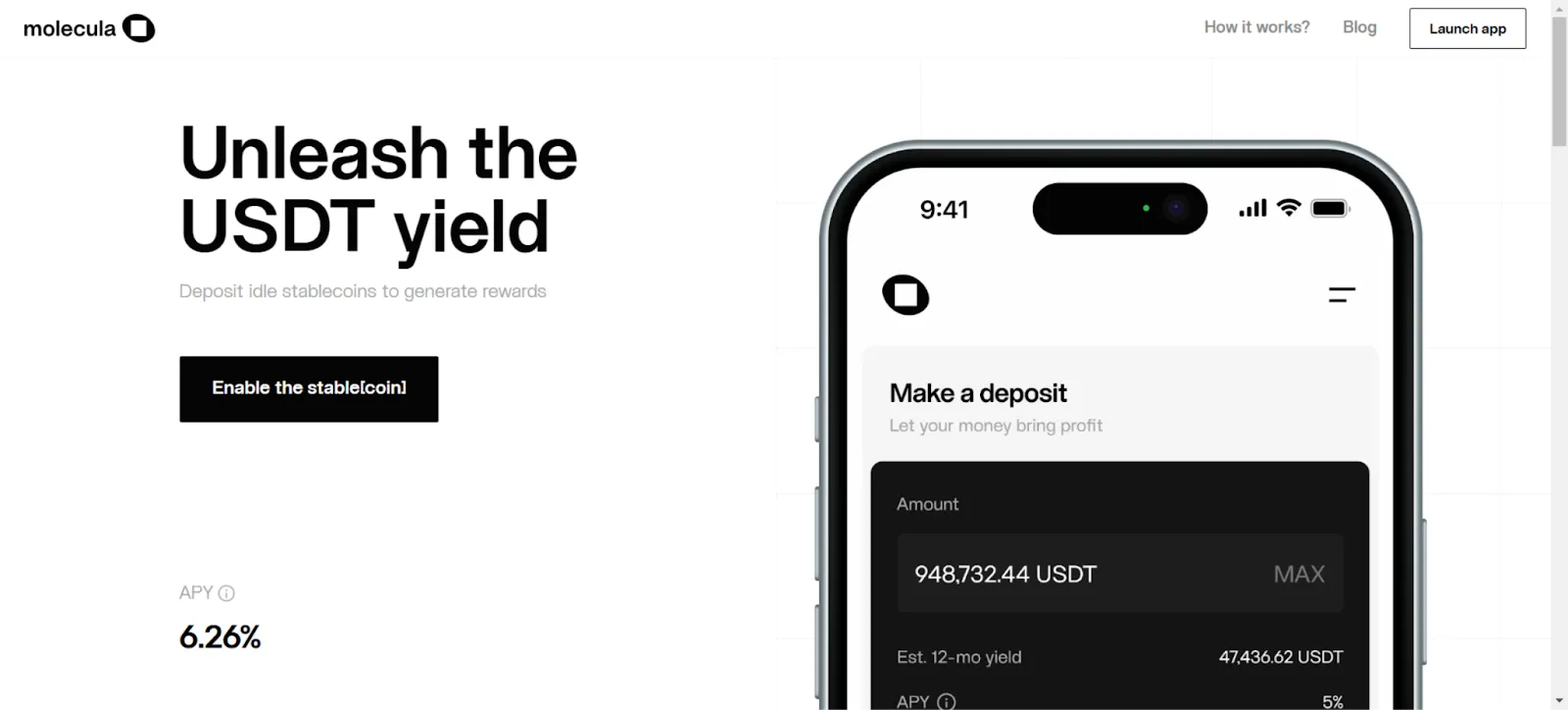

If you want to gain returns on cryptocurrencies, try Molecula. It is a yield-generation platform that deposits your USDT across different DeFi platforms and RWAs. This is especially profitable if you have idle USDT tokens.

Conclusion

Building passive income through your online presence is much like making smart investments—it requires strategy, consistency, and time. Start investing in your online presence today, and let it work for you around the clock.